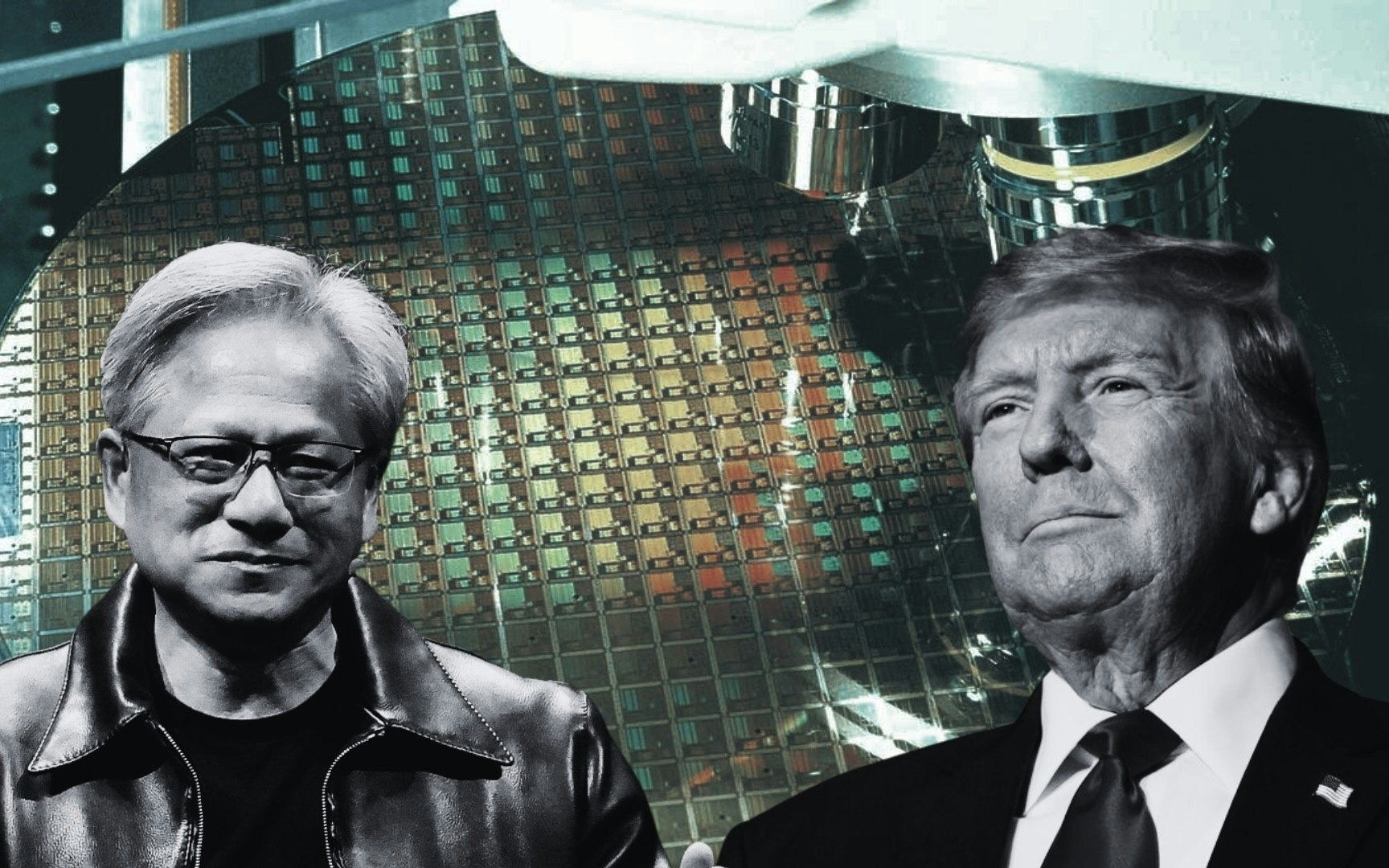

Nvidia and the Stargate Initiative: A $500 Billion AI Push

Nvidia’s stock has been on an explosive run, hitting record highs as investors rally behind the company’s growing influence in artificial intelligence. A key driver? Former President Donald Trump’s AI mega-deal, the $500 billion Stargate Initiative. This ambitious project, aimed at revolutionizing AI infrastructure in the U.S., has positioned Nvidia as a central player, fueling a staggering 46% surge in its stock value over recent months.

The Stargate Initiative: Powering the AI Arms Race

Announced as a cornerstone of Trump’s vision for technological dominance, the Stargate Initiative brings together industry giants like OpenAI, SoftBank, and Oracle to build a vast AI ecosystem. At its core are state-of-the-art data centers and power plants designed to support next-generation AI models. Nvidia’s dominance in high-performance AI chips makes it a critical supplier for these infrastructures, solidifying its market leadership.

This partnership has sent a strong signal to investors, reinforcing Nvidia’s strategic advantage. With its high-performance GPUs and AI accelerators set to power the Stargate data centers, the company’s revenue potential has skyrocketed. Analysts now project Nvidia’s valuation could cross the $3 trillion mark in the coming years, mirroring Apple’s and Microsoft’s dominance in their respective fields.

Investor Confidence: Why Nvidia Stock is Soaring

Since the initiative’s unveiling, Nvidia shares have climbed steadily, reflecting Wall Street’s confidence in its AI supremacy. The 4% stock rise immediately following the announcement was just the beginning. Institutional investors view Nvidia as the backbone of the AI revolution, banking on its hardware to drive global AI expansion.

Beyond government-backed projects, Nvidia’s AI solutions are now integral to various industries, from autonomous driving and healthcare to fintech and defense. This diversified application ensures sustained demand for its chips, reinforcing long-term growth.

Challenges and Geopolitical Risks

While the Stargate Initiative presents lucrative opportunities, it also brings regulatory scrutiny. The U.S. government faces a delicate balancing act—on one hand, it seeks to accelerate AI leadership; on the other, it must restrict advanced chip sales to China. With growing concerns over AI technology reaching Chinese military and intelligence agencies, Nvidia must navigate potential trade restrictions that could impact global revenue streams.

Additionally, scaling AI infrastructure on such a massive level requires addressing energy consumption, supply chain constraints, and cybersecurity risks. Nvidia’s ability to mitigate these challenges will be pivotal in sustaining its rapid growth.

The Road Ahead: Nvidia’s Future in AI

With the AI arms race intensifying, Nvidia stands at the forefront, leveraging its technological prowess to dominate the sector. The company’s involvement in the Stargate Initiative underscores its critical role in shaping the next phase of AI development. As global demand for AI processing power escalates, Nvidia’s strategic positioning within government and private-sector projects places it in an enviable position for sustained expansion.

As the dust settles, one question remains: Can Nvidia maintain its meteoric rise, or will geopolitical roadblocks stall its momentum? Investors and tech enthusiasts alike are watching closely as the AI revolution unfolds.